Company cars in Belgium: your new taxes

03 Apr 2012January 2012 marks the beginning of a new calculation of the ‘Benefit in kind’ - the value an employee is calculated to get from a company car. It has a big effect on your taxes. Do you pay taxes in Belgium? Do you have a company car? Read on!

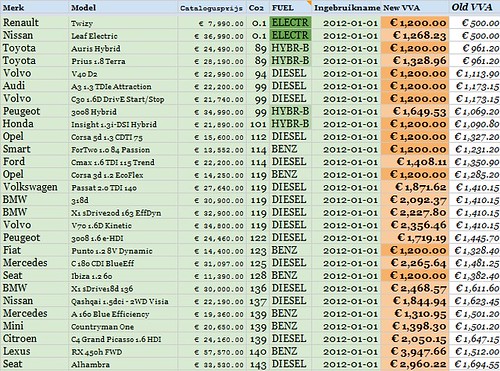

The actual formula can be found here: Arval: Benefit in kind (FR: Avantage de toute nature / NL: Voordeel van alle aard). I simulated this for my own car (Saab 9.3 Cabrio from 2005). It’s clear I need to sell it ASAP. Then I started calculating some other ‘common’ company cars to see what car to buy next. A hybrid? Diesel? Start-stop? So here are some numbers for the ‘cheap’ cars:

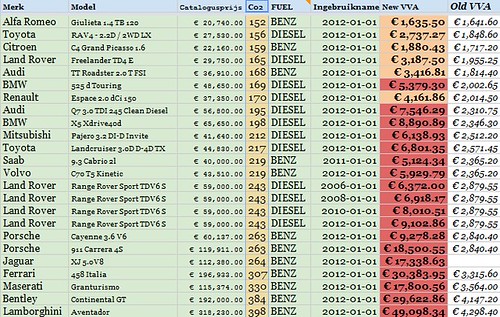

And because you’re right to worry about your company Range Rover:

Conclusions

- There is a minimum benefit: 1200€/year. Some cars would have been able to go lower than that, like some electric/hybrid ones, the Volvo V40, the Audi A3, the Smart, but no, you are still going to be taxed for those 1200. 1200, so the state considers you to make 100€/month more.

Concretely: for an electric car, you are going to be taxed as if it costed 30.000€. For the most economic petrol/diesel car: as if it costs 21.818€. If your company has 22K to spend on a car, use it. You can’t save on your tax filing anyway. - Accessories and options: they are also taken into account for the price of your car. The leather seats, the GPS pack, the xenon lights… They all count.

- CO2 coefficient is important, but don’t overdo it. The treshold for petrol (benzine) cars is 115 g/km, and for diesel it’s 95 g/km. You pay more if it’s worse, but you don’t pay less if it’s better.

For diesel cars: stay under 115 g/km. For petrol cars, stay under 130. - Electric cars: you would be surprised. Apart from the Renault Twizzy, which is more of a toy, there are not that many options, and you’re not even sure of the minimum benefit. If the car costs more than 30K, you’re screwed. Hybrid cars: if they cost more than 22K, you will feel it.

- SUVs: if you have a big SUV (BMW X5, Mercedes M, Porsche Cayenne) or a big jeep (Landcruiser, Pajero), you’re gonna feel the pain. Nissan Qashqai, Toyota RAV4, not so much.

- Second hand: there is a discount for the age of your car: 6% per year, with 5 years max. So if your car is 6 to 25 years old (after which it becomes an old-timer), the state will take into account 70% of the price it was bought for the first time. But if you bought it second hand? You might buy a 2 year old car for 50% of the price, but it will still be counting for 88% of the price-for-a-new-one. Concretely: if you buy a second hand Maserati, don’t buy it in the company.

- “Super cars“. I know you love to watch Top Gear and dream about that Lamborghini, but I’m guessing that has become something even more of the happy few. If you buy/lease it as a company car, you will bleed in your personal taxes. 20K for that Porsche Carrera (so you will pay +- 50% of that in taxes). 10K for that Range Rover.

As far as I understand it, this is for new ànd second-hand cars, bought or leased by a company for a manager or employee. Let’s wait until some accountants come up with new schemes for expensive cars.

In the mean time: what individual wants to buy a Saab Cabrio?